|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Equity Loan Rates in Texas: A Comprehensive GuideHome equity loans are a popular financial tool for homeowners in Texas looking to leverage the equity in their homes. These loans can offer competitive interest rates and favorable terms, but it's important to understand how they work and what to expect. What Are Home Equity Loan Rates?Home equity loan rates refer to the interest rates charged on loans that are secured by the borrower's home equity. These rates can vary based on several factors, including the borrower's credit score, the amount of equity in the home, and prevailing market conditions. Factors Affecting Home Equity Loan Rates in Texas

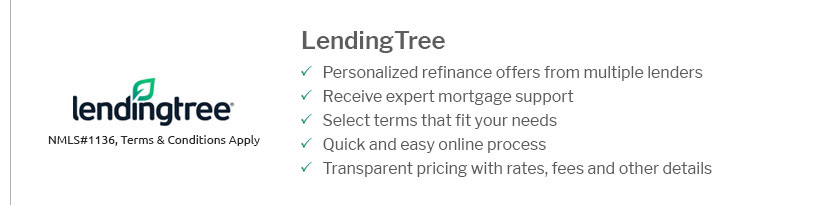

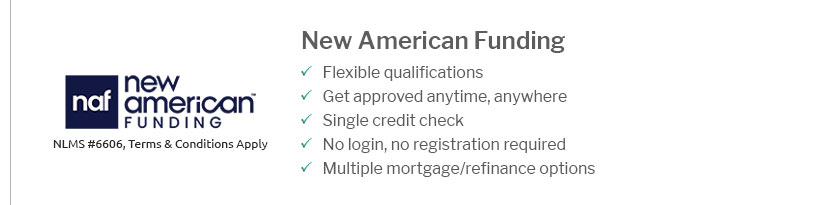

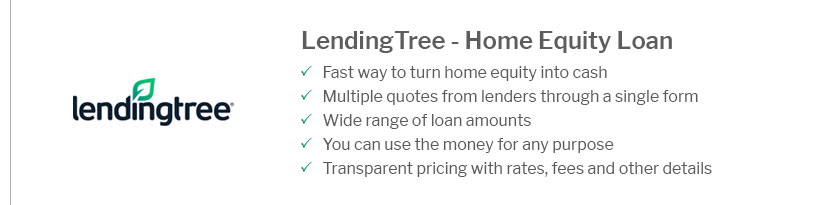

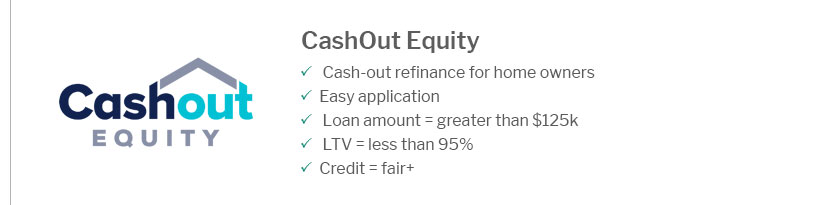

To explore how these factors interact, it's useful to compare them with other financial products such as 20 year jumbo mortgage rates. Current Trends in Texas Home Equity Loan RatesInterest rates for home equity loans in Texas can fluctuate based on economic trends. Recently, rates have shown a mix of stability and slight increases, depending on broader market trends. Comparing Rates Across LendersDifferent lenders may offer varying rates and terms. It's crucial to shop around and compare options before committing to a loan.

For veterans and service members, exploring va mortgage interest rates today could provide valuable insights into specialized loan options. Frequently Asked Questionshttps://www.texanscu.org/rates/home-loans

Home Improvement Loan Rates ; 61 to 120 Months $15,000 to $100,000 6.500% 6.545% - $15,000 to $100,000 ; 121 to 180 Months $20,000 to $100,000 6.750% 6.782% ... https://aplusfcu.org/loans/home-loans/home-equity

$495 processing fee for loans less than $40,000. $795 processing fee for loans $40,000 and above. Under Texas law, the combined loan-to-value (CLTV) cannot ... https://utxcu.com/loans/home-loans/home-equity-loans/

In Texas, you may have only one Home Equity Loan or Home Equity Line of Credit per property at a time. If your current loan is a HELOC or Home Equity, it must ...

|

|---|